Reactions to the 2022 Autumn Statement

Shweta Singh provides her immediate thoughts on the 2022 Autumn statement.

The Chancellor’s Autumn Statement may appear to be guided by fiscal discipline, but under the hood, it is a redistributive budget, focused on an election timeline. It is a complete U-turn from his predecessor’s focus on ‘trickle down economics’. In crafting a budget that neatly segments the pre-2025 and post-2025 fiscal periods, with this statement, Chancellor Hunt is starting to draw up the battlelines for the next General Election. There clearly have been difficult decisions to make. But some of the fine-tuning on these decisions have been safely deferred e.g. the pace of fiscal consolidation. Other decisions are more pressing e.g. the near-term trade-offs between supporting the vulnerable amidst a cost-of-living crisis.

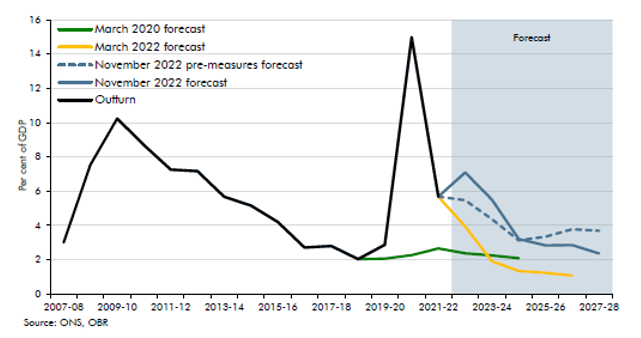

Chart: Public Sector net borrowing

Tax

The tax burden is projected to be higher than all the five budget announcements this year. The share of taxes to GDP is expected to peak at 37.5% of GDP in 2024-25. This would be its highest level since the end of the Second World War. Some of the tax measures mentioned in this statement include levying a windfall tax on energy firms, freezing tax thresholds for various types of taxes, and lowering the threshold for highest wage earners. But despite the tax increases, public net borrowing actually increases over the next couple of years when compared to projections prior to today’s announcements (see chart above).

Cost of living

Public spending as a share of GDP projection is also higher than at any time this year. The aim is to cushion the cost of living squeeze, especially on the most vulnerable. The government will extend the energy price cap for households for twelve months. However, the cap will be raised from the current £2,500 to £3,000 from April 2023. Means-tested benefits and pensions will rise by 10%. The national living wage is also going to increase by just under 10% from next year. The nil-threshold reduction for stamp duty will be extended till March 2025. There will be also be one-off cost of living payments to eligible households: £900 for those on means-tested benefits, £300 for pensioners and £150 for those with disabilities. Spending on NHS, social care and schools will increase, although it will be largely offset by reducing aid spending.

Fiscal outlook

It seems that the fiscal adjustment is set to be “just enough” to get government through the next two years. They are taking the inevitable hit to confidence that will arise from higher headline taxation early but slowing down the trajectory of reducing net borrowing. They will be looking to see the benefits accrue into 2024 as, on forecast, economic activity stabilises. However, there are still a number of implicit assumptions within the OBR’s projections regarding risks to the economy that are outside of the government’s control, especially geopolitical risks.

Separately, the fiscal outlook is now less muddled for the Bank of England. Chancellor Hunt’s fiscal policy is much less extravagant than his predecessor Kwarteng’s, nonetheless fiscal spending will remain large. Cyclically-adjusted net public borrowing is likely to increase from 7.3% of GDP in FY 2022 to 7.5% in FY 2023. This will remain expansionary at 5% in FY 2024. The Bank of England needs to stay put on its tightening path at least until the supply and demand imbalances in the labour market have eased meaningfully.